Retirement may seem like a distant concept as a college graduate embarking on your career. However, the reality is that the earlier you start planning for retirement, the better positioned you’ll be to enjoy a financially stable future.

This article will explore the importance of early retirement planning for college graduates and provide practical tips and strategies to help them secure their financial well-being.

Table of Content

The Importance of Retirement Planning for Graduates

What Does Regular vs. Early Retirement Mean?

Early retirement refers to the decision to stop working and transition into a period of leisure and financial independence before reaching the typical retirement age. While the normal retirement age in America is 65, early retirement allows individuals to retire earlier, often in their 50s or before.

On the other hand, regular retirement refers to retiring at the typical retirement age, around 65 years old. At this age, individuals can access retirement benefits, such as Social Security. They may stop working or reduce their working hours to enjoy their later years.

The Lure of Early Retirement

Early retirement offers the opportunity to have more time to pursue personal interests, travel, spend time with family, or engage in meaningful activities. It provides individuals with financial freedom and flexibility to enjoy their retirement years while they are still relatively young and healthy.

However, it's important to note that early retirement requires careful financial planning and saving to ensure that one has enough funds to sustain their lifestyle throughout their retirement years. It may involve making lifestyle adjustments, such as reducing expenses and managing investments wisely, to make the retirement savings last longer.

Overall, early retirement allows individuals to retire earlier than the typical retirement age, giving them more freedom and flexibility to enjoy their retirement years while requiring careful financial planning to ensure a secure and comfortable future.

Debunking Common Misconceptions About Early Retirement

Early retirement is a dream for many, often painted as a life of leisure and absolute freedom by those who achieve it.

However, behind the allure lie several misconceptions that may catch graduate students off guard. Let's debunk a few common myths surrounding early retirement and shed light on the financial planning and sacrifices required to achieve this goal.

It's All About Not Working

- Misconception: Early retirement is often misunderstood as a perpetual vacation, where individuals simply cease working without financial considerations.

- Reality: Successful early retirement demands meticulous financial planning, disciplined saving, and strategic investments. It's not about avoiding work entirely but choosing work that aligns with personal passions or pursuits, offering a fulfilling lifestyle.

Social Security Benefits Misconception

- Misconception: Some believe early retirement won't significantly impact their Social Security benefits.

- Reality: Retiring early may lead to a reduction in Social Security benefits. Understanding the implications and optimizing the timing of your retirement maximize these crucial income streams in the long run.

Freedom vs. Financial Responsibilities

- Misconception: Early retirement is often associated with complete freedom from financial obligations.

- Reality: While early retirees may enjoy more flexibility, financial responsibilities persist. Maintaining a secure financial footing requires ongoing attention, from healthcare costs to unexpected expenses. It's crucial to strike a balance between freedom and responsible financial management.

Healthcare Coverage Misconception

- Misconception: Some believe that healthcare coverage will be a minor concern in early retirement.

- Reality: Healthcare costs can be a substantial part of early retirement expenses. Understanding the options available, such as private insurance or government programs, and planning for potential healthcare needs is crucial to avoid unexpected financial burdens.

Underestimating Longevity

- Misconception: People might underestimate their lifespan and the duration their retirement savings need to last.

- Reality: With advancements in healthcare, individuals are living longer. Underestimating the number of years in retirement can lead to inadequate savings. Proper financial planning should consider a longer retirement horizon to ensure a comfortable and secure lifestyle.

Acknowledging the truths behind these misconceptions ensures you approach your financial planning with a clearer, more realistic perspective.

Financial independence requires planning, informed decision-making, and an understanding of the implications of early retirement on various aspects of your life.

Early Retirement = Starting to Save for Retirement Early

Retirement planning is crucial for individuals who wish to retire before the regular retirement age. By starting to save for retirement early, you have a greater opportunity to accumulate the necessary funds to support your desired lifestyle during your retirement years.

One key advantage of early retirement savings is the power of compounding interest. The compounding effects will see your investment earnings generate additional returns over time. The longer the investment horizon, the greater the growth potential.

Moreover, an early start allows you to weather market fluctuations and adjust your investment strategies accordingly. A longer time horizon allows for a slightly more aggressive investment approach, potentially leading to higher returns in the long run.

Another important aspect—retirement planning provides a clearer understanding of future financial needs. By setting clear retirement goals and creating a comprehensive financial plan, you’ll be able to assess your current and future financial situation, identify gaps, and make adjustments to ensure you are on track to meet your retirement objectives.

Furthermore, saving for retirement early on reduces financial stress in later years. Knowing you’ve taken the necessary steps to secure your financial future provides security and peace of mind. This peace will allow you to focus on enjoying your retirement years without worrying about financial constraints.

Understanding the Different Retirement Savings Options Available

Individual Retirement Accounts (IRAs)

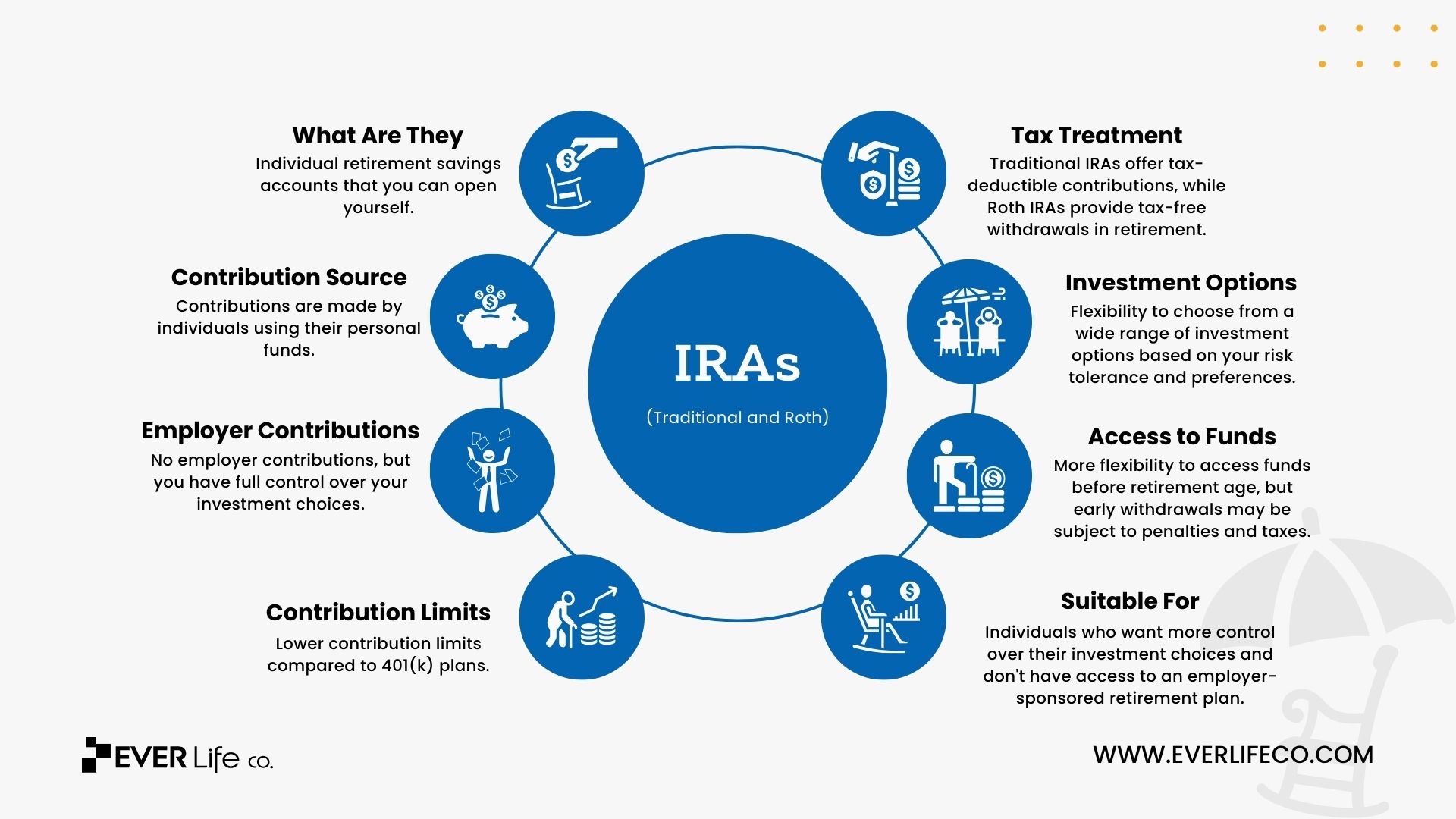

Individual Retirement Accounts (IRAs) are personal retirement savings accounts that allow for tax-advantaged contributions.

These accounts allow saving and investing money for retirement while enjoying certain tax benefits. Contributing to an IRA can reduce taxable income in the contribution year, enabling participants to save more for the future.

In an IRA, earnings, and growth are tax-deferred, allowing for the maximization of savings potential and a larger nest egg upon retirement by not paying taxes on investment gains before withdrawals.

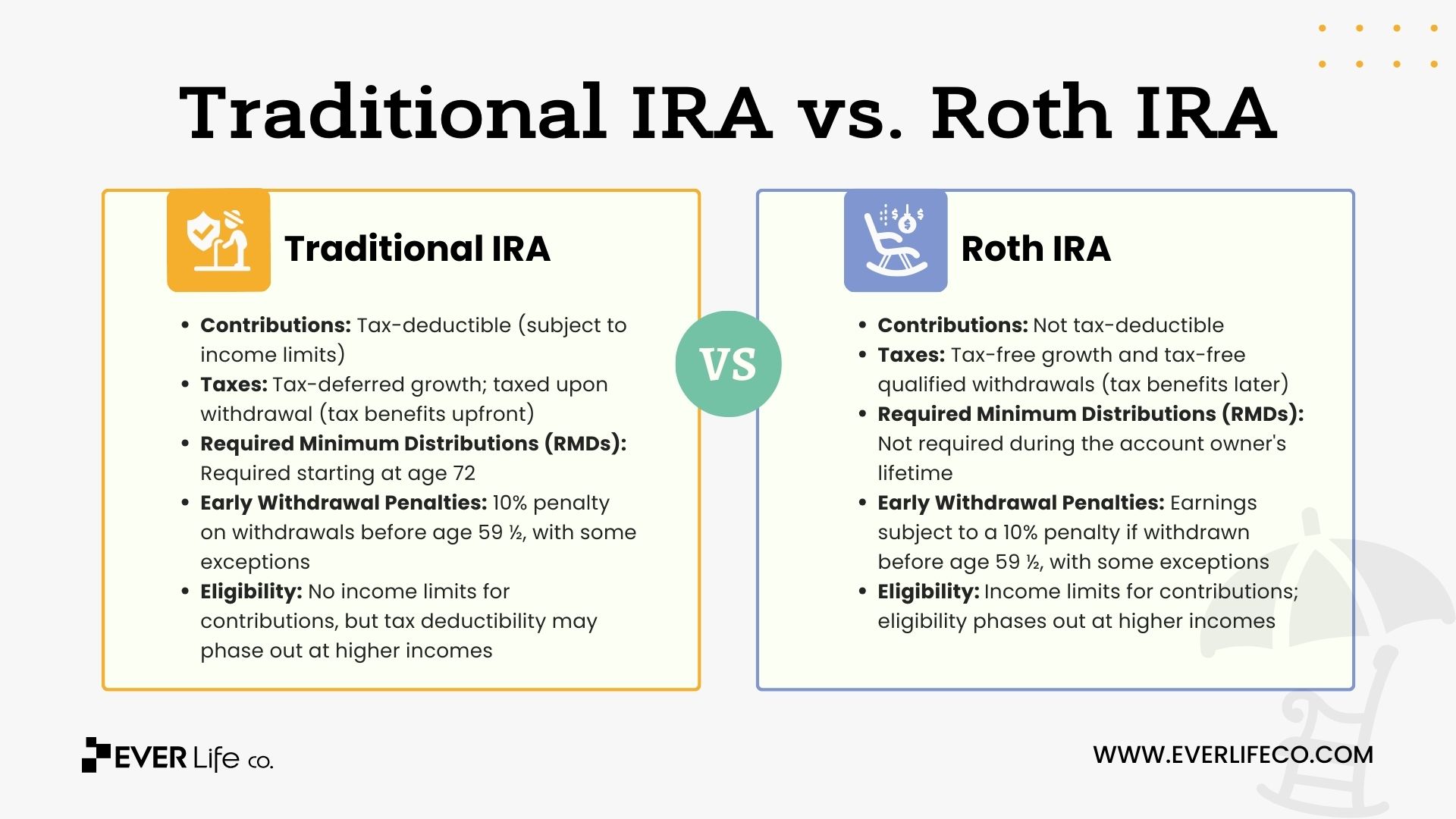

- How do they work: There are two main types of IRAs: Traditional and Roth. With a Traditional IRA, contributions may be tax deductible, and earnings grow tax-deferred until withdrawal. With a Roth IRA, contributions are not tax-deductible, but qualified withdrawals are tax-free.

- Pros: Potential tax advantages, flexibility in investment choices, and the ability to contribute even if not covered by an employer-sponsored retirement plan.

- Cons: Contribution limits, potential early withdrawal penalties, and income limitations for Roth IRA eligibility.

- Who would benefit most: Individuals looking for tax advantages and flexibility in investment choices.

401(k) Plans

401(k) plans are retirement plans employers provide to their employees.

These plans allow employees to save for their retirement by allowing them to contribute a percentage of their salary to a dedicated retirement account.

By participating in a 401(k) plan, employees benefit from tax advantages and employer-matching contributions, which help grow retirement savings faster. It’s a valuable benefit that helps participants secure their financial future by building a nest egg for their retirement years.

- How do they work: Contributions are made on a pre-tax basis, and earnings grow tax-deferred until withdrawal. Some employers also offer matching contributions, which increases the overall savings.

- Pros: Employer matching contributions, higher contribution limits compared to IRAs, and the ability to automate contributions through payroll deductions.

- Cons: Limited investment options determined by the employer, potential early withdrawal penalties, and restrictions on accessing funds before retirement age.

- Who would benefit most: Employees with access to a 401(k) plan who want to take advantage of employer matching contributions.

Simplified Employee Pension (SEP) IRA

A Simplified Employee Pension (SEP) IRA is a popular retirement option for self-employed individuals and small business owners. It offers tax advantages and allows individuals to save for future retirement needs.

SEP IRA offers the advantage of tax deductions while building a nest egg for their retirement years. With a SEP IRA, there’s the flexibility to choose the amount for yearly contributions, making it a customizable and adaptable retirement savings option.

- How does it work: Contributions are made by the employer, and the amount contributed is typically based on a percentage of the employee's salary.

- Pros: Higher contribution limits compared to Traditional and Roth IRAs, potential tax deductions for employer contributions, and flexibility in contribution amounts from year to year.

- Cons: Limited to self-employed individuals and small business owners with eligible employees, potential early withdrawal penalties, and potential administrative complexity.

- Who would benefit most: Self-employed individuals and small business owners who want a retirement plan with higher contribution limits and the flexibility to adjust contributions based on income/profit fluctuations.

Defined Benefit Plans

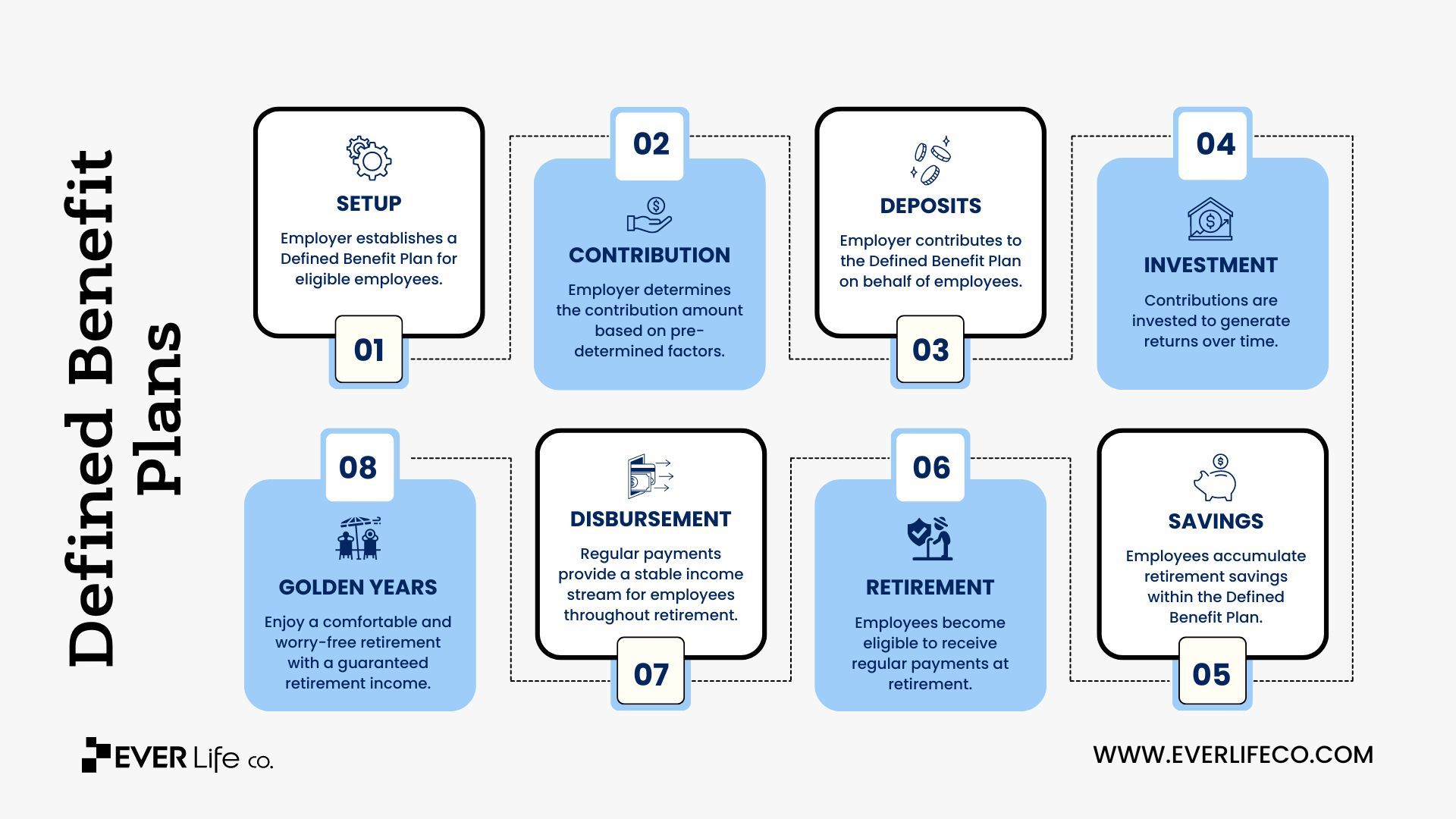

Defined Benefit Plans, also known as pension plans, are retirement plans that provide a specific benefit amount upon retirement.

Contributions to a Defined Benefit Plan may be mandatory or voluntary for employees throughout their working years. Employers make a bulk of the contributions. The accumulated funds are then invested to generate returns supporting the promised benefit amount.

Employees become eligible to receive regular payments from the plan upon retirement, providing a stable income stream. This income ensures that individuals can maintain their standard of living and enjoy a comfortable and worry-free retirement.

- How do they work: Contributions are made by the employer, and the benefit amount is typically based on factors such as the employee's salary and years of service.

- Pros: Guaranteed retirement income, potential tax deductions for employer contributions, and professional management of investments.

- Cons: Limited to employers offering these plans, potential lack of portability if changing jobs, and potential administrative complexity making it the costliest option on this list.

- Who would benefit most: Employees who value a guaranteed retirement income and work for employers offering Defined Benefit Plans.

Note: The flow chart is a simplified representation of the process involved in a Defined Benefit Plan. It highlights the key steps and outcomes of the plan to help individuals understand how it works.

Resource for further reference: Types of Retirement Plans (IRS)

These are only a few examples of retirement savings options available. When selecting the most suitable retirement savings option, research and consider your financial situation and goals.

How to Calculate Retirement Savings Goals Based on Individual Financial Situations

We all have an image of what we want our lives to be like in later years. The goals you set now should all funnel toward the desired end, but each path will be different. There is no one set way, as individual circumstances, lifestyle, and financial goals vary.

So, how do you calculate retirement savings goals based on your unique financial situation?

Understand Your Finances

You may know where you want to go, but where are you now? The answer to the latter will help you map out how to achieve the former with a higher chance of success.

Understanding one's current financial situation and being realistic about what you can achieve (at present) are essential aspects of retirement planning. Understanding your current income, expenses, and savings is crucial. By assessing your financial situation, you can determine how much you’re able to save for retirement and what adjustments may be necessary.

Being realistic about your current financial capabilities allows you to set achievable retirement savings goals. Milestones you can achieve without compromising other financial obligations. Encouragement from hitting these milestones will fuel your momentum.

On the flip side, failure because you’ve set your cap out of reach may discourage you from progressing.

Dream Big, But Within Reason Based on Your Life Stage

Coming to terms with your starting point helps you make informed decisions about your retirement planning. It enables you to evaluate the feasibility of your desired retirement lifestyle and make necessary adjustments to ensure financial security in the future.

This realistic approach considers your current circumstances or life stage so you can create a retirement plan that aligns with your financial capabilities and goals.

How to Evaluate Your Current Financial Landscape

Assessing your current financial situation is an important step in retirement planning.

Here are some steps to help you evaluate your current financial landscape:

Step 1: Gather financial information

Start by collecting all relevant financial documents, including bank statements, investment account statements, credit card statements, and any other documents that provide a snapshot of your current financial situation.

Get copies of your credit report from the three major credit bureaus—TransUnion, Experian, and Equifax. The information in these reports may differ as each agency uses a unique model and metrics to calculate your credit score.

Check if all the information is correct and correct discrepancies immediately. Errors may negatively affect your credit score, which lenders and some employers use to determine your credit and trustworthiness.

Step 2: Analyze your income and expenses

Review your income sources and calculate your monthly income. Then, examine your expenses and categorize them into essential (e.g., housing, food, utilities) and discretionary (e.g., entertainment, travel) expenses.

This breakdown will help you understand your spending habits and identify areas where you can cut back to increase your savings.

Learn about how to create a budget.

Step 3: Review your savings and investments

Evaluate your current savings and investment accounts, such as retirement accounts (e.g., 401(k), IRAs), brokerage accounts, and other investment vehicles. Consider the growth rate of your investments and assess the performance of your portfolio.

Step 4: Assess your debt

One of the primary stumbling blocks recent graduates encounter is debt.

Take stock of your outstanding debts, including credit card debt, student loans, and any other you may have on your records. Calculate the interest rates, monthly payments, and remaining balances. This assessment will help you understand your debt obligations and consider strategies for debt management.

Weighing your debt against your income will also show you the debt-to-income ratio. Lenders and other financial institutions consider this ratio when setting the terms of contracts.

Step 5: Consider your financial goals

With an understanding of where your current funding stands and where each dollar is going, it’s time to look ahead to the future.

Reflect on your retirement goals and aspirations. Determine the lifestyle you envision for your retirement years and estimate the expenses associated with that lifestyle. Consider healthcare costs, insurance, travel plans, housing, and any other financial commitments you anticipate during retirement.

What changes will you have to make to your current spending habits? Is it time to consider a second income stream? A sacrifice now is an investment in your future.

Step 6: Consult a financial advisor

If you feel overwhelmed or need more clarification about assessing your financial situation, seek guidance from a professional financial advisor. They can provide personalized advice and help you develop a comprehensive retirement plan based on your circumstances.

By thoroughly assessing your current financial situation, you will have a solid foundation for creating a retirement plan that aligns with your goals and enables you to work towards a financially secure future.

Review and update your assessment as circumstances change. Regular evaluations will help you stay on track and make necessary adjustments to ensure you are on the right path toward your retirement goals.

Paying Off Student Loans While Saving for Retirement

Student loan debt is a significant milestone for many college students. The high-interest rates on student loans can lead to a substantial financial burden, making it crucial to prioritize debt reduction to free up funds for retirement savings.

Unfortunately, there are external factors to consider. Factors that, without a strategic approach, will hamper your debt repayment goals.

Factor 1: The Money-Making Power of Your Degree

Your career is a major deciding factor in how much money you'll make. How much you make determines your budget distributions and how easy and fast you can make debt payments.

The average student loan debt in America is $37,338 per borrower, with private student loan debt averaging $54,921 (Hanson). The average college graduate's entry-level salary is around $58,862.

Paying off debt accelerates the path to financial independence. It unlocks the potential for robust retirement savings and long-term financial well-being. But it can be challenging to do, considering the money you make.

Your yearly potential earning depends on the sector you work in and your degree level.

Factor 2: Location Matters

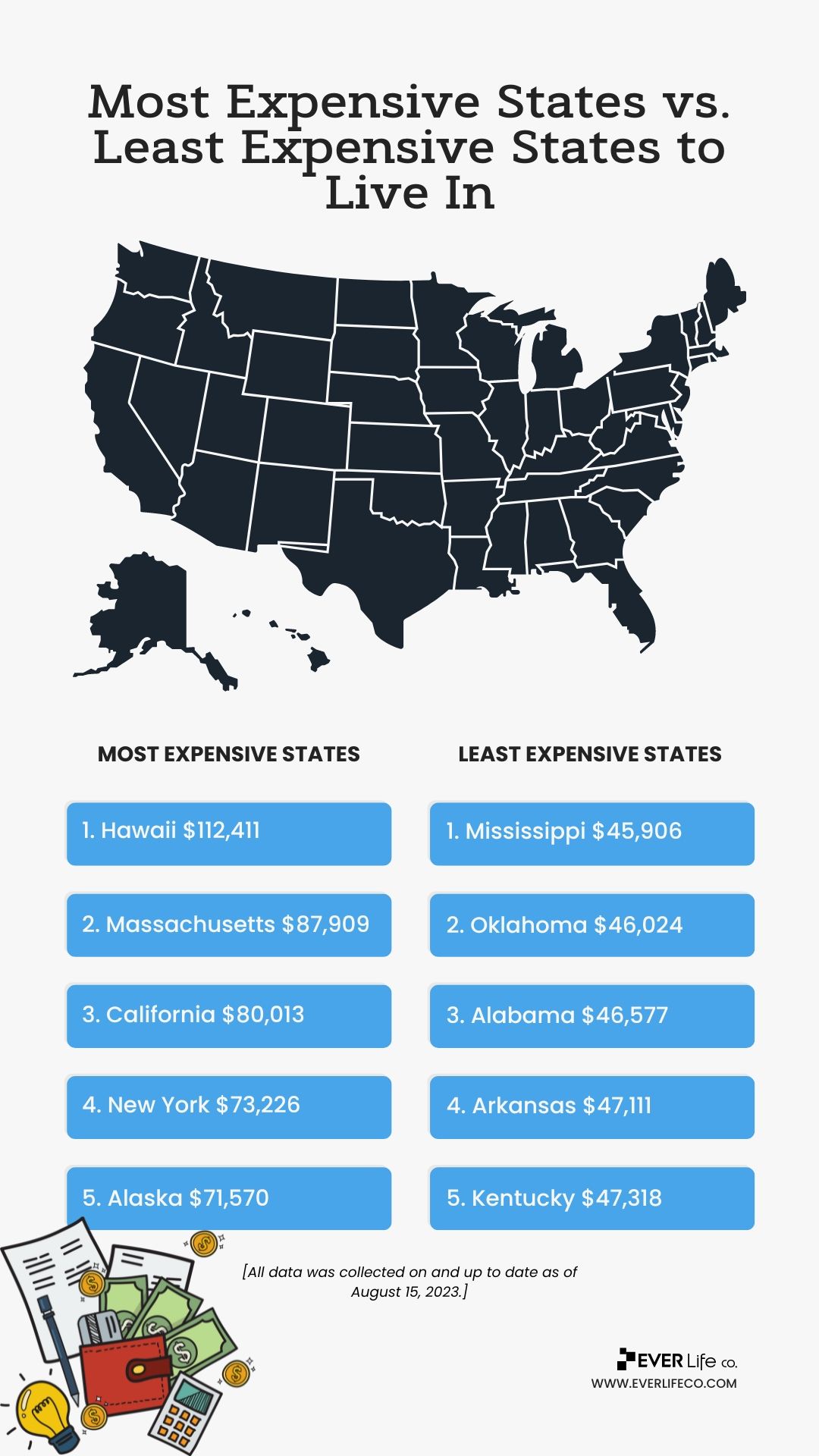

Where you live will also determine how well you manage your debt repayment and still handle the rest of your responsibilities.

$58,862 is $1662 more than the average living wage [$52,700] in America, as noted by a GOBankingRates study that analyzed the living wage required for a single person across all states.

Where you live determines your cost of living to a great extent. With inflation, state-based taxes, and the cost of other variable expenses, changing location might be a short or long-term solution to freeing up extra money to clear your balances.

Consider the cost of living when planning your financial future and retirement goals. Understanding the expenses associated with different states will help you make informed decisions about where to live and how to manage your finances effectively.

Tips for Managing Student Loan Debt While Saving for Retirement

Managing student loan debt while saving for retirement can be a challenging balancing act, especially for recent graduates.

However, with careful planning and smart financial strategies, navigating these hurdles and working towards a secure financial future is possible.

Here are some tips to help you manage student loan debt while saving for retirement:

Step 1: Create a Budget

Start by creating a budget that outlines your monthly income and expenses. You would have gathered all the necessary details during your evaluation and categorized your expenses.

Prioritize your student loan payments and allocate a portion of your income towards retirement savings. By tracking your spending and living within your means, you can ensure that you are making progress on both fronts.

Step 2: Explore Repayment Options

You must repay your student loan to avoid being in a bind. Repercussions include:

- Damage to credit score;

- Late payment fees and accrued interest;

- Collection efforts noted on your credit report;

- Wage garnishment (forced deductions) to repay the loan;

- Loss of deferment or forbearance benefits;

- Legal action resulting in court judgments or asset seizure.

Starting and consistently making payments on your student loan not only helps you establish a credit history but also offers potential tax benefits. You can claim up to a $2,500 student loan deduction if your adjusted gross income or MAGI is less than a specified amount, which the IRS sets annually.

Research and understand the various repayment options available for your student loans. Depending on your financial situation, you may qualify for income-driven repayment plans or loan forgiveness programs.

These options help make your monthly student loan payments more manageable, freeing up funds to contribute towards retirement savings.

For more advice on how to repay your student loan, visit the Consumer Financial Protection Bureau for helpful resources.

Step 3: Prioritize High-Interest Debts

If you have multiple debts, prioritize paying off high-interest debts first. Save money on interest payments in the long run by tackling high-interest loans, such as credit card debt or private student loans.

Once you’ve paid off these high-interest debts, allocate more funds towards retirement savings.

Step 4: Take Advantage of Employer Benefits

If you have access to employer benefits, such as a 401(k) plan with matching contributions, take full advantage of them.

Contribute enough to receive the maximum employer match (5 or 6%), essentially “free money” to boost your retirement savings. While allocating all your funds towards student loan repayment may be tempting, don't neglect the long-term benefits of retirement savings.

Step 5: Consider Refinancing or Consolidating Loans

If you have multiple loans with high-interest rates, explore the option of refinancing or consolidating them.

Refinancing allows you to secure a lower interest rate, reducing your monthly payments and saving money in the long run. However, carefully assess the terms and conditions of refinancing or consolidation to ensure it aligns with your financial goals.

Step 6: Build an Emergency Fund

An emergency fund is a financial safety net, providing a cushion for unexpected expenses such as medical emergencies, car repairs, or job loss. It's a crucial component of financial planning as it prevents falling into debt when faced with unexpected financial challenges.

It offers peace of mind, preventing the need to rely on credit cards or loans during unforeseen circumstances and ensuring financial stability.

Set up your emergency fund as soon as possible. Building your reserve takes time, and the unexpected can happen suddenly. Be diligent with your deposits. Settling debts without paying penalty fees will help you contribute more to your retirement savings plan.

Managing student loan debt while saving for retirement requires discipline, patience, and a long-term perspective. Work towards a more secure financial future by making informed financial decisions and finding a balance between debt repayment and retirement savings.

Calculating Monthly Payments

Putting all the numbers together from this section, let's look at a mock monthly budget for a new college graduate living on an entry-level income with student debts.

Budget Description:

Monthly budget for a new college graduate with an annual income of $58,862, considering a 24.8% tax rate. We'll also factor in the federal student loan debt of $37,338 to be repaid within ten years, along with allocations for regular savings, an emergency fund, and retirement.

Gross Monthly Income:

- $58,862 / 12 months = $4,905.17

Taxes:

The exact amount will depend on various factors like state taxes, deductions, etc. As a rough estimate, let's assume a 24.8% tax rate:

$4,905.17 * 0.248 = $1,219.22 (estimated taxes)

Net Monthly Income:

- $4,905.17 - $1,219.22 = $3,685.95 per month

Student Loan Repayment:

- $37,338 / 10 years = $3,733.80 per year

| Description | Percentage of Net Income ($3,685.95)* | Calculations | Monthly Spend* |

|---|---|---|---|

| Student Loan Repayment | ≈ 8.44% | $3,733.80 / 12 months | $311.15 |

| Regular Savings | 10% | $3,685.95 * 0.10 | $368.60 |

| Emergency Fund | 5% | $3,685.95 * 0.10 | $184.30 |

| Retirement Savings | |||

| (annual contribution limit 10-15%) | 10% | $3,685.95 * 0.10 | $368.60 |

| Housing | 30% | $3,685.95 * 0.30 | $1,105.79 |

| Utilities | 10% | $3,685.95 * 0.10 | $368.60 |

| Food | 15% | $3,685.95 * 0.15 | $552.89 |

| Transportation | 10% | $3,685.95 * 0.10 | $368.60 |

- All calculations are estimates of a mock budget

Total Expenses: $3628.53 per month

Remaining cash after expenses: $3,685.95 - $3628.53 = $57.42

The 3 Key Principles for Strategic Retirement Planning

Three fundamental principles will support you in making sound investment decisions and creating a robust financial portfolio.

Principle 1: Diversified Portfolio Allocation

A diversified portfolio is a critical element of sound retirement planning. It reduces management risks commonplace in any type of investment you undertake. Along with risk management, diversification maximizes returns on your money.

By spreading investments across various asset classes, such as stocks, bonds, real estate, and other alternative investments, you’ll create a well-balanced portfolio that can withstand market volatility and generate long-term growth.

Let's discuss what diversified portfolio allocation can do for you.

1 | Risk Mitigation:

Diversification spreads investment risk across different asset classes (e.g., stocks, bonds, real estate). Since different assets react differently to market conditions, having a mix of investments reduces the portfolio's overall risk.

2 | Market Volatility Protection:

Financial markets are volatile, with the value of individual assets fluctuating. Diversification protects your portfolio from the impact of a poor-performing asset class. When one asset is down, another might be up, helping to stabilize the overall portfolio.

3 | Long-Term Growth Potential:

Different asset classes have different risk and return profiles. While stocks offer higher growth potential, they also come with higher volatility. Bonds, on the other hand, provide stability but may offer lower returns. By diversifying, you can capture the potential growth of various asset classes over the long term.

4 | Adaptation to Changing Market Conditions:

Market conditions change over time. Certain asset classes may outperform during specific economic cycles, while others underperform. Diversification allows your portfolio to adapt to changing market conditions, reducing the impact of economic downturns on your overall wealth.

5 | Reduction of Concentration Risk:

A concentrated portfolio with a few stocks or assets exposes you to specific company or sector risks. If one of these companies or sectors faces challenges, it can significantly impact your portfolio. Diversification minimizes concentration risk by spreading investments across various companies, industries, and geographic regions.

6 | Preservation of Capital:

Diversification helps protect your capital by limiting exposure to any investment's poor performance. This protection is vital as you approach retirement, where capital preservation becomes a priority to ensure a stable income stream.

7 | Income Stream Stability:

For retirees relying on their investment portfolios for income, a diversified mix of income-generating assets (e.g., dividend-paying stocks and bonds) provides a more stable and predictable income stream.

8 | Behavioral Benefits:

Diversification also has psychological benefits. During market turbulence, having a well-diversified portfolio promotes discipline. It prevents you from making emotional decisions that could negatively impact long-term financial goals.

9 | Inflation Hedge:

Diversified portfolios may include assets that historically have acted as hedges against inflation. This is important for retirees as inflation erodes purchasing power over time, and having investments that can outpace inflation is essential for maintaining your desired lifestyle.

10 | Customization to Risk Tolerance and Goals:

Diversification allows for customization based on risk tolerance, time horizon, and financial goals. A well-structured, diversified portfolio will align with your unique preferences and needs.

Principle 2: Tax-Efficient Investment Choices

Like diversification, tax-efficient investment choices protect your money and maximize monetary returns.

Utilizing tax-advantaged accounts such as 401(k)s and IRAs and implementing tax-efficient investment strategies like holding investments for the long term and maximizing opportunities for tax loss harvesting are wise financial decisions for cash retention.

Make Tax-Advantaged Accounts Work for You

Contribute to tax-advantaged retirement accounts such as 401(k)s and IRAs. These accounts offer tax benefits on contributions (traditional accounts) or withdrawals (Roth accounts).

Contributions to traditional accounts are often tax-deductible, providing an upfront tax benefit. In contrast, Roth accounts allow for tax-free withdrawals in retirement.

Strategic Withdrawals

Plan withdrawals from retirement accounts strategically to manage taxable income. This strategy includes diversifying accounts, such as taxable, tax-deferred, and tax-free accounts, and managing withdrawals based on their distinct tax treatments.

Strategic planning may involve selling assets with minimal capital gains for taxable accounts. Withdrawals from tax-deferred accounts need careful timing to stay within specific tax brackets, considering factors like required minimum distributions (RMDs) and minimizing the taxation of Social Security benefits.

Additionally, leveraging Roth accounts strategically contributes to tax-free income in retirement.

The flexibility of strategic withdrawals allows retirees to adapt to market conditions, manage healthcare premium considerations, and plan for legacy goals.

Regular review and adjustments are essential to align the strategy with changing tax laws and individual circumstances. Consulting with a financial or retirement planner will help tailor these strategies to specific retirement plans.

Financial Assets with Built-in Tax Efficiency

Consider the tax efficiency of different asset classes and allocate them strategically across taxable and tax-advantaged accounts.

For example, investments with higher tax efficiency, like index funds or tax-managed funds, may be placed in taxable accounts. In contrast, less tax-efficient assets, such as actively managed funds with frequent capital gains distributions, may be held in tax-advantaged accounts.

Principle 3: Regular Portfolio Rebalancing

Rebalancing is a proactive strategy that promotes financial discipline and helps navigate the dynamic nature of financial markets, ultimately contributing to the long-term success of retirement savings.

Risk Management

Portfolio values fluctuate over time due to market movements. Regular rebalancing helps maintain the desired level of risk by ensuring that the asset allocation aligns with the investor's risk tolerance and financial goals.

Rebalancing prevents the portfolio from becoming too heavily weighted in high-risk assets during bull markets or overly conservative during bear markets.

Asset Allocation Alignment

As different asset classes perform differently, the initial asset allocation of a portfolio may shift over time. Regular rebalancing brings the allocation back in line with the original targets.

Realigning with changes ensures that the portfolio remains diversified, capturing the potential benefits of various asset classes and preventing overexposure to any single type of investment.

Cash Flow Management

During retirement, individuals often rely on their investment portfolios for income. Regular rebalancing ensures that the portfolio's asset allocation remains appropriate for your income needs.

Rebalancing may involve adjusting the mix of income-generating assets, such as bonds or dividend-paying stocks, to provide a steady cash flow while managing risk.

Adaptation to Changing Goals and Time Horizons

Retirement savings goals and time horizons change due to life events, economic conditions, or personal circumstances. Regular rebalancing adjusts investment portfolios in response to these changes.

Realign your investment portfolio as you near retirement or enter a new life stage to reflect your evolving goals and risk tolerance.

Periodically adjust the portfolio to align with target allocations and ensure your investment portfolio remains aligned with their retirement goals and risk tolerance.

Conclusion

Whatever strategy or combination of strategies you use for planning your retirement will be unique to your financial situation. There isn't a one-size-fits-all option.

Evaluate your current financial landscape and consider your financial goals. With a clear appreciation of both, you’ll be better positioned to create a retirement plan that aligns with your aspirations and ensures a financially secure future.

Managing your debt and savings will be paramount to this endeavor.

Saving for things like an emergency fund or retirement can be easy to put off, especially when you're young and not earning a lot of money. But don't underestimate the power of compounding. Even saving small amounts each month can lead to significant savings by the time you retire.

To optimize retirement planning, adhere to the three fundamental principles.

- Diversify your investment portfolio across various asset classes to mitigate risk, protect against market volatility, and maximize long-term growth potential.

- Make tax-efficient investment choices, such as contributing to tax-advantaged accounts and planning strategic withdrawals to optimize tax benefits and preserve capital.

- Regular portfolio rebalancing ensures risk management, alignment with asset allocation targets, cash flow management, and adaptation to changing goals and time horizons.

Retirement planning is an ongoing process that requires regular evaluation and adjustments as circumstances change.

Consult a financial advisor for personalized guidance to navigate the complexities of retirement planning as you work toward a financially secure future and the lifestyle you envision for your golden years.

Citations

- Hanson, Melanie. “Average Student Loan Debt.” EducationData, 22 May 2023, educationdata.org/average-student-loan-debt#:~:text=The average federal student loan.

- IRS.gov. “Types of Retirement Plans | Internal Revenue Service.” Irs.gov, 2018, www.irs.gov/retirement-plans/plan-sponsor/types-of-retirement-plans. Accessed 5 Jan. 2024.