Creating a solid business succession plan is crucial for business owners, but it's often overlooked until it's too late. In Part 1 of this series, we discussed the importance of this plan and the first steps you should take to create one.

In Part 2, we'll cover the remaining steps you need to take to create a successful business succession plan.

- Addressing Legal and Financial Considerations

- Communicating the Succession Plan

- Implementing a Succession Plan

- Ensuring Business Continuity

- Reviewing and Updating the Succession Plan

So, if you’re ready to secure the future of your business, let’s get started.

Addressing Legal and Financial Considerations

Consulting with Legal and Financial Professionals

Addressing your succession plan’s legal and financial considerations is crucial for a seamless ownership transition and preserving your business’s value.

Seek legal and financial advice from qualified professionals with experience in business succession planning to ensure compliance with legal requirements, mitigate risks, and optimize the financial outcomes of your plan.

1 | Engage Legal Professionals

Consult with experienced lawyers who specialize in business succession planning. They will provide valuable advice on legal requirements, compliance with regulations, and drafting necessary legal documents such as buy-sell agreements, transfer agreements, and shareholder agreements.

2 | Seek Financial Expertise

Work with reputable accountants and financial advisors to ensure that your succession plan aligns with your financial goals and maximizes the financial benefits for you and the successor(s).

They will help assess the financial implications of different succession options and provide guidance on tax planning and wealth preservation.

Reviewing Business Structure, Contracts, and Agreements

Review your business structure, contracts, and agreements as part of your succession planning process. Consider the following:

1 | Evaluate Business Structure

Assess whether your existing business structure is suitable for the succession plan. Depending on the nature of your business and the succession goals, it may be necessary to restructure the business, such as transitioning from a sole proprietorship to a corporation or creating a family trust.

Consult legal and financial professionals for advice on the most appropriate structure for your situation.

2 | Review Contracts and Agreements

Review all relevant contracts, agreements, and insurance policies. Ensure they accurately reflect the current state of the business and address necessary updates for the succession plan.

These updates include examining key agreements such as supplier, customer, lease, and employment contracts. Handle the necessary amendments or transfers immediately to ensure a smooth transition of responsibilities and obligations.

Learn about Key Man Insurance and how it can safeguard your business against the loss of key personnel on your team.

Assessing Tax Implications and Estate Planning

Different succession options may have varying tax consequences. Consult with tax professionals to evaluate the tax implications of each scenario, such as a sale, gift, or transfer of ownership.

They will help you navigate tax laws, exemptions, and potential strategies to minimize tax liabilities for both parties.

Succession and Estate Planning

Take into account estate planning strategies to preserve wealth and minimize taxes. These strategies may involve structuring trusts, creating a will, establishing a family limited partnership, or utilizing other estate planning tools.

Engage the services of estate planning professionals to ensure the protection and distribution of your assets according to your wishes.

Communicating the Succession Plan

Foster understanding, build trust and ensure everyone is aligned and supportive throughout the transition with a clear and transparent communication strategy.

Sharing the Plan with Key Stakeholders

Once you’ve developed your succession plan, communicate it to key stakeholders.

Family Members

If the succession plan involves passing the business to family members, initiate open and honest discussions. Clearly explain the plan, its reasons, and the opportunities it presents.

An equitable transition will reduce the chances of disputes between family members. Manage concerns and expectations they may have and ensure everyone understands their roles and responsibilities.

Employees

Communicate the succession plan to your employees in a timely and transparent manner. Help them understand how the transition will impact them and address possible concerns regarding job security, career development, and changes in leadership positions.

Employee engagement reduces anxieties over their position at the company, which can hamper productivity. Highlight the plan’s benefits, such as increased opportunities for the development of skills and the continuity of the company.

Investors and Business Partners

Inform your investors and business partners about the succession plan and how it will affect the company. Provide reassurance regarding the stability of the business and the continued focus on growth and profitability.

Maintain open channels of communication to answer questions or concerns they may have.

Addressing Concerns and Answering Questions

During the communication process, anticipate potential points of resistance from stakeholders.

Anticipate Concerns: Put yourself in the shoes of your stakeholders and anticipate their anxieties and inquiries.

Common concerns include uncertainty about the future direction of the organization, likely changes in management style, and disruptions during the transition. Prepare thoughtful responses to alleviate these concerns and provide reassurance.

Maintain Open Communication: Encourage stakeholders to voice their concerns and ask questions by creating a supportive and safe working environment for open dialogue. Listen actively and empathetically to their perspectives, and provide honest and transparent responses. Clear communication builds trust and fosters a smoother transition.

Face difficult questions head-on. Masking the truth can have dire repercussions for your company’s reputation. Building a business’s reputation takes years; only a single misstep can cause irrefutable damage.

Establishing a Clear and Transparent Communication Strategy

Establish a clear and transparent communication strategy to ensure effective communication throughout the succession process.

- Define Communication Channels: Determine the appropriate channels for communication, such as staff meetings, company-wide emails, newsletters, or dedicated information sessions. Utilize various channels to reach different stakeholders effectively.

- Frequency of Communication: Establish a regular communication schedule to keep stakeholders informed about the progress of the succession plan. This may include weekly updates, milestone announcements, town hall, or quarterly meetings. Consistent communication demonstrates your commitment to transparency and keeps stakeholders engaged.

- Celebrate Milestones: Highlight milestones achieved during the succession process. Celebrate successes and communicate them to stakeholders to foster a sense of progress and momentum. These celebrations will help to instill confidence and maintain enthusiasm among stakeholders.

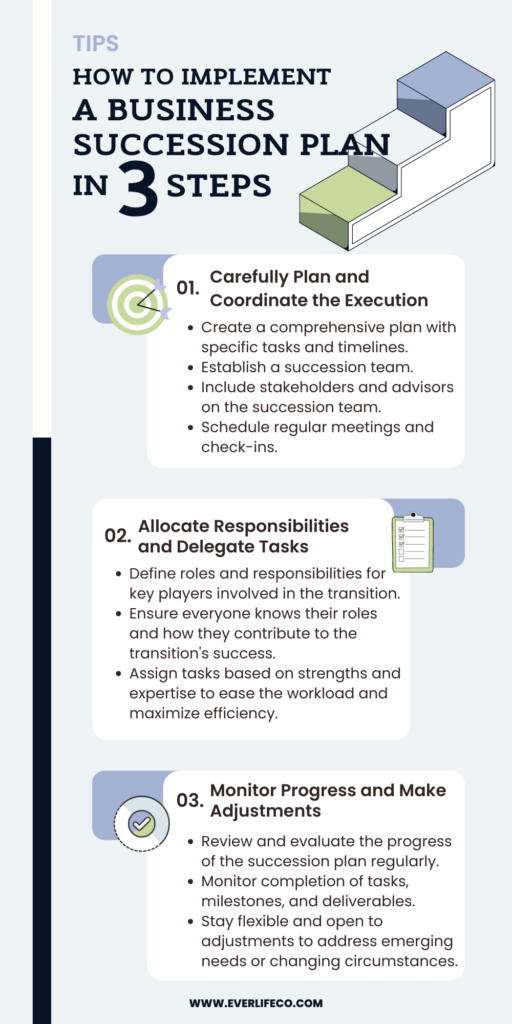

Implementing a Succession Plan

A well-executed plan ensures that the transition occurs seamlessly and minimizes disruptions to the business. Your approach directly impacts the outcome, although it’s impossible to anticipate every issue you might encounter.

All the same, an effective implementation strategy should tie in all the above steps and reflect the desired results of your hard work.

Effective Succession Planning for a Smooth Transition

Implementing a succession plan requires careful planning and coordination.

Clearly Outline Tasks and Timelines: Detail the specific steps, tasks, and timelines for the transition. Create a comprehensive plan that clearly defines each stage of the process, from preparing the successor(s) to transferring responsibilities.

This outline provides a roadmap for execution and helps maintain accountability.

Create a Succession Team: Establish a succession team to oversee the plan’s implementation. This team can include key stakeholders, including current and future leaders, HR professionals, and advisors. They will coordinate efforts, monitor progress, and address challenges that arise during the transition.

Regular meetings and check-ins will help ensure everyone is working towards the common goal of a successful succession.

Allocating Responsibilities and Delegating Tasks

Assign clear roles and responsibilities for a seamless implementation of the plan.

Assign Clear Roles: Clearly define the roles and responsibilities of key players involved in the transition. This includes the outgoing owner, the successor(s), and other key employees who will manage the organization during and after the change.

Each individual should clearly understand their responsibilities and how they contribute to the overall success of the transition.

Delegate Tasks: Delegate tasks based on individual strengths, expertise, and capacity. Consider the skills and knowledge required for each task and assign them to individuals equipped to handle them.

Delegating tasks eases the burden of the workload falling on one person and allows each to focus on their areas of expertise.

Monitoring Progress and Making Necessary Adjustments

After the plan’s implementation, monitor its progress to ensure it stays on track.

Regular Progress Reviews: Regularly review and evaluate the progress of the succession plan. Monitor the completion of tasks, milestones, and key deliverables. Regular monitoring allows you to identify bottlenecks or areas that require additional attention or resources.

Progress reviews keep the implementation on track and provide an opportunity to make adjustments if necessary.

Adaptability and Flexibility: Be prepared to adapt the plan as circumstances change. Business environments are dynamic, and unforeseen events or challenges may arise during the succession process.

Stay flexible and open to adjustments needed to guarantee a successful transition. Regularly reassess and modify the plan to address emerging needs or changing circumstances.

Ensuring Business Continuity

An essential benefit of your succession plan is to prevent significant disruption to your company’s operations. Create strategies for mitigating the impact of unexpected events, facilitating a seamless handover of responsibilities, and supporting the successor(s) in their new role.

Developing a Contingency Plan for Unexpected Events

While succession planning aims to provide an effortless transition, prepare your team for unexpected events that could undermine the process.

Prepare for Unforeseen Events

Identify potential risks that could impact the succession plan, such as the sudden illness or disability of key leaders or unexpected departures.

Develop a contingency plan to address these scenarios, outlining action steps and alternative courses of execution.

Identify Backup Plans and Alternative Successors

Identify backup successors or individuals who can step in temporarily to fill critical roles. A robust talent management system will ensure you retain a selection of internal candidates to provide interim leadership during emergencies for continued business operations.

Documenting Critical Processes and Procedures

Document critical processes and procedures. It’s the first step in ensuring everyone is on the same page.

Create Comprehensive Documentation

Document key business processes, systems, and contacts in a comprehensive language. Include step-by-step instructions, best practices, and other relevant information.

These documents (physical and digital) will serve as valuable resources for current and future leadership, ensuring continuity and minimizing disruptions.

Accessibility of Information

Ensure the documented information is easily accessible to key individuals during the transition. Store the documentation in a secure and centralized location, utilizing digital platforms or cloud storage or providing physical access to key personnel.

Easy access to critical business information facilitates a smooth handover of responsibilities and enables the new leadership to make informed decisions.

While creating your documentation, simplify complex knowledge about the operation and maintenance of critical systems. Distill roles and responsibilities in your company’s employee handbook and stress the importance of staying up-to-date with company knowledge.

Establishing a Support Network for the New Leadership

The company is a community of individuals playing designated roles and acting as drivers of success for the business. Your successor requires their and your support for successful integration into their new role.

Ongoing Support

Provide ongoing support to the successor(s) during the transition and beyond. Provide mentorship, coaching, and regular check-ins to address challenges or concerns.

Your guidance and support help to guarantee a smooth transition and set the new leadership up for success.

Facilitate Introductions and Relationships

Help the successor(s) establish relationships with key stakeholders such as clients, suppliers, and employees.

Introduce them to important contacts and facilitate meetings and interactions to foster trust and a seamless transition of relationships.

Building these connections will contribute to the successor(s)’ ability to effectively lead the company.

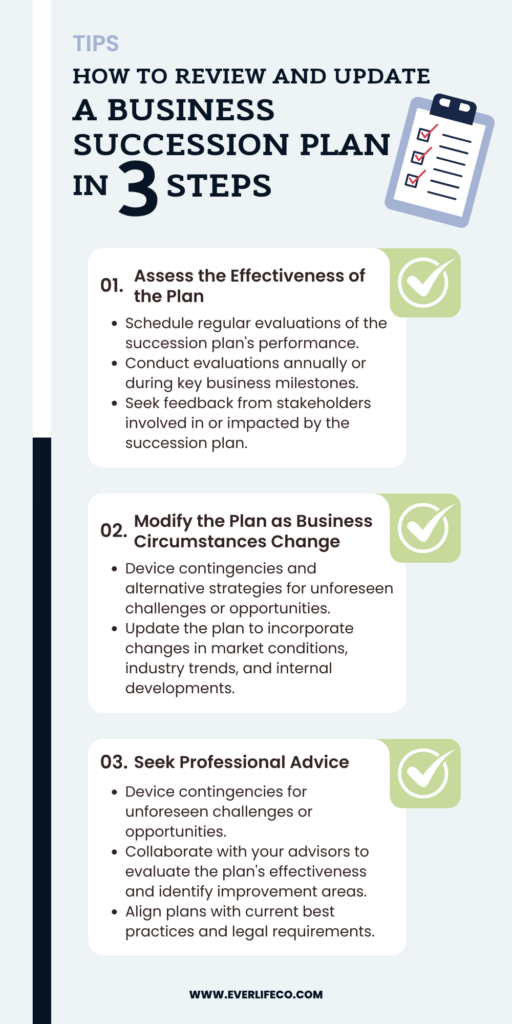

Reviewing and Updating the Succession Plan

The first version of your plan is not often the last. Things change. Employees designated in the plan may leave the company or change their minds about their career plans.

The iterative nature of reviewing and updating the plan allows you to manage these evolving needs and maintain a successful and sustainable succession process.

Regularly Assessing the Effectiveness of the Plan

A succession plan should not be a static document but a dynamic tool that evolves with the business and its changing needs.

Schedule Periodic Evaluations

Set a schedule for regular evaluations of the succession plan’s performance. These check-ins allow you to review its effectiveness and identify areas needing improvement.

Conduct these evaluations annually or during key business milestones.

Solicit Feedback from Stakeholders

Seek feedback from stakeholders involved in or impacted by the succession plan. This includes family members, employees, investors, and advisors. Their insights can provide valuable perspectives on how well the plan is working and identify areas for refinement or adjustment.

Modifying the Plan as Business Circumstances Change

Create a flexible and adaptable plan to accommodate changes in a constantly evolving business landscape.

Keep the Plan Flexible

Design the succession plan with flexibility in mind. Build in contingencies and alternative strategies that can be activated when business circumstances change.

Flexibility allows you and your team to respond to unforeseen challenges or opportunities without compromising the plan’s overall success.

Update the Plan as Needed

As new opportunities or challenges arise, periodically revisit and update the plan accordingly. Incorporate changes in market conditions, industry trends, and internal developments.

Regularly updating the plan ensures its continued relevance and alignment with your business objectives.

Periodic Evaluations with Professional Advisors

Best practices change over time as an industry evolves. You won’t be able to keep up with all of these changes, so you’ll need a team of trusted experts you can consult with.

Engage Professional Advisors

Periodically consult with legal, financial, and succession planning experts to review and refine your plan. These professionals possess specialized knowledge and can offer guidance on legal and regulatory requirements, tax implications, and strategic considerations.

Leverage Their Expertise

Collaborate with your professional advisors to evaluate the effectiveness of the succession plan and identify areas that may need improvement. They will help you navigate complex issues and ensure your plan aligns with current best practices and legal requirements.

Conclusion

Passing the torch of your business to someone else is not easy. It requires careful planning and hard work. But with a rock-solid plan, you can ensure your business will thrive long after you’re gone.

Following the steps outlined in this two-part guide, you can navigate the complexities of succession planning and lay a solid foundation for a seamless transition.

Initial Evaluation and Strategy Planning

- Understand succession planning and how it can help mitigate business disruption during the transition period.

- Assess your business and personal goals to lay the groundwork for your timeline and overall transition process.

- Identify potential successors within your organization, externally, and within your family if you’re operating a family-owned business to fill key leadership roles.

- Developing a transition timeline based on your initial evaluation of your goals and the potential candidates you have to work with.

After Initial Evaluation

- Seek legal and financial advice about structuring an effective succession plan and limiting the chances of negative impacts.

- Communicate the plan to relevant stakeholders and garner their feedback to ensure everyone is on the same page and understands what they should expect.

- Once you’ve crafted a solid plan, implement the necessary pre-succession objectives. One of these objectives might be your employee development plan to prepare prospective candidates with the core competencies to fill future leadership positions.

- Develop contingency plans and document standard operating procedures as a part of your business continuity strategy.

- Review and update your succession plan to reflect the company’s evolving needs and shifts in the industry.

Early planning and collaboration with stakeholders and trusted professionals with expertise in succession planning will contribute to a successful succession process.

Safeguard your business and embrace the opportunity to create a legacy that will continue to thrive for generations.